2024 Initial public offerings annual summary

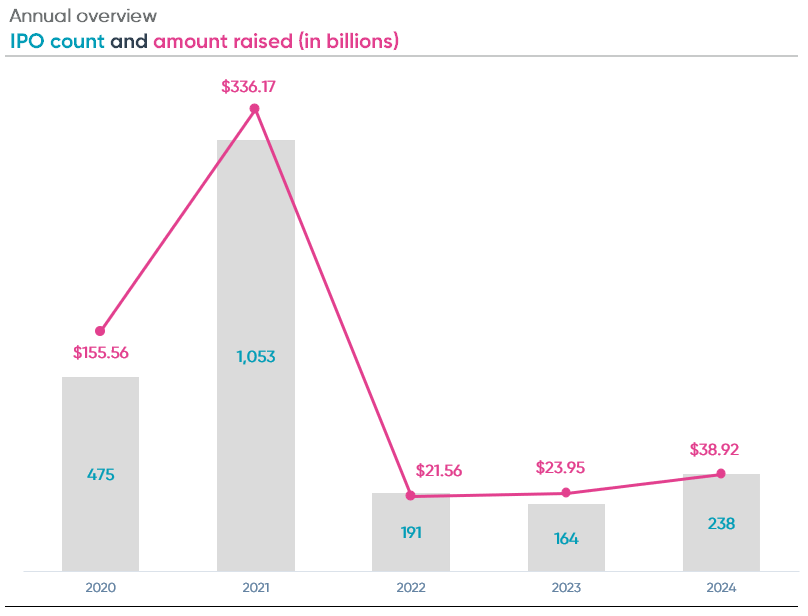

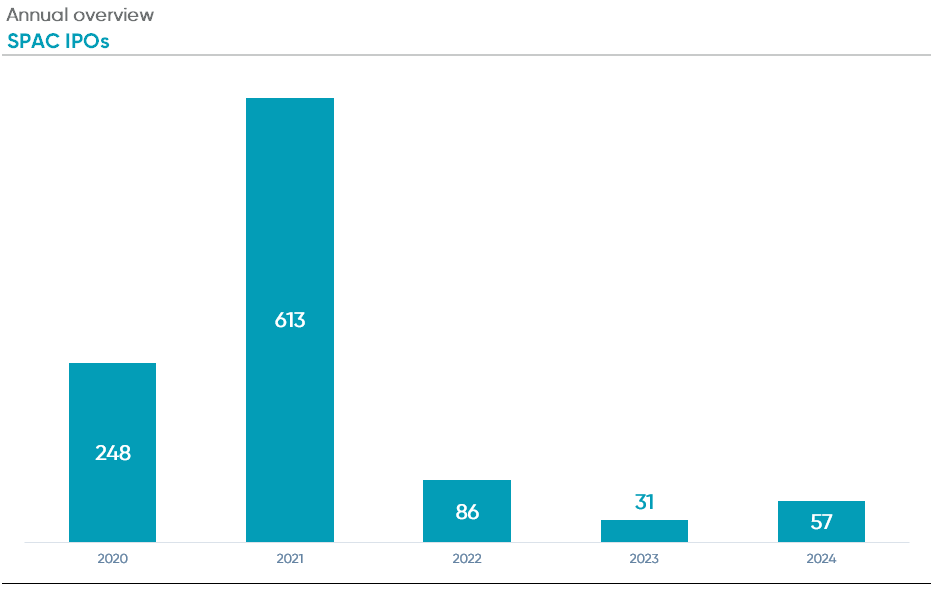

Initial public offerings (IPOs) rebounded slightly after experiencing a five year low in 2023. There were 238 new listings during 2024 which together raised $38.9 billion. Compared to 2023, total IPOs increased by 45% while total proceeds increased 63%. Additionally, the average size of the listings was greater in 2024 at an average of $165 million per IPO compared to $145 million in 2023. 2021 is regarded as the height of the SPAC boom where 613 SPACs underwent an IPO contributing the massive figures for gross proceeds and total IPO count.

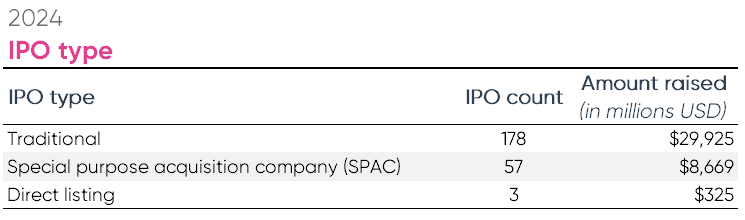

IPO type

Traditional IPOs were the most common type of public offering in 2024. There were 178 traditional IPOs that raised a combined total of nearly $30 billion, averaging $170 million per offering. Compared to 2023, the number of traditional IPOs increased by 36% while total proceeds raised increased by about 50%, or $10 billion.

There were three direct listings in 2024, a new form of publicly listing shares that has emerged in recent years. Direct listings now allow companies to offer their shares directly to the public, upon the SEC’s approval of their registration statement, bypassing the underwriting process. Zenatech, Inc., a Canadian AI drone company, was the largest direct listing in 2024 raising $177 million from their offering on NASDAQ in October.

Special purpose acquisition companies (SPAC) are public companies with no commercial operations that are formed for the express purpose of merging with or acquiring a private company. SPACs raise money through an IPO, after which, the money raised is placed into an interest-bearing trust that can be used for the purpose of an acquisition. SPAC IPOs have fallen dramatically since the SPAC boom of 2021. There were 57 SPAC IPOs in 2024, an 84% increase from 2023. Together, these SPAC IPOs raised nearly $8.7 billion up from $3.4 billion in 2023. SPAC IPOs in 2024 raised an average of $152 million per listing. The largest SPAC IPO for 2024 was EQV Ventures Acquisition Corp. which raised $350 million and is currently searching for acquisitions in the energy sector.

Largest IPOs

Lineage, Inc. was the largest IPO in 2024. The company operates temperature-controlled warehouses used by the perishable food industry. Lineage, Inc. raised $4.44 billion from its listing on NASDAQ in July. While it was the leading IPO for 2024, Lineage, Inc. was also the sixth largest IPO since 2020.

Viking Holdings Ltd. ranked second in terms of proceeds raised for 2024 IPOs. An operator of luxury cruises, Viking listed on the NYSE in May, raising $1.54 billion.

StandardAero, Inc., the third largest IPO of 2024, went public in the fourth quarter of 2024 and raised $1.44 billion. The aircraft maintenance, repair and overhaul (MRO) provider currently trades on the New York Stock Exchange.

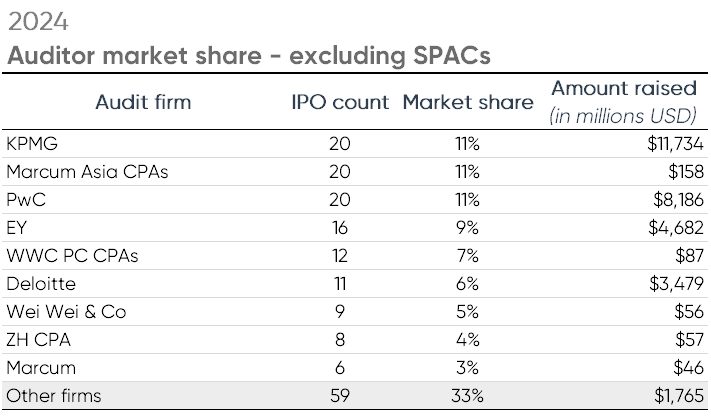

Auditor market share – excluding SPACs

Three firms tied for the most IPO clients audited in 2024, excluding SPACs. KPMG, Marcum Asia and PricewaterhouseCoopers (PwC) audited the most non-SPAC IPOs in 2024, each holding 11% of the market share and 20 clients each.

KPMG led in terms of gross proceeds with their 20 clients raising a combined total of $11.7 billion. PwC followed in total client gross proceeds with $8.19 billion while Marcum Asia trailed by a significant margin with a total of $158 million raised by its 20 clients. Fellow Big Four member EY held 16 clients who raised a total of $4.68 billion, an improvement on client count and gross proceeds raised compared to 2023. Deloitte saw a large drop off in terms of total gross proceeds. Deloitte’s 12 IPO clients in 2023 raised $7.4 billion, while their 11 clients in 2024 raised less than half of that figure at $3.48 billion

In total, 48 different firms audited the 181 IPOs, excluding SPACs, completed in 2024.

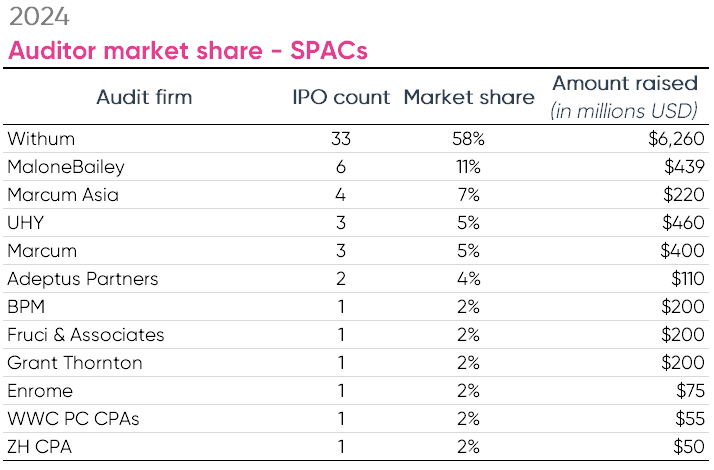

Auditor market share – SPACs

WithumSmith + Brown PC ranked number one in terms of SPAC IPO clients, auditing 58% of all SPAC IPOs in 2024. MaloneBailey and Marcum Asia ranked second and third with six and four SPAC IPO clients, respectively. Withum’s 33 clients raised the most total proceeds at a combined total of nearly $6.26 billion.

In total, twelve firms audited the 57 SPAC IPOs completed in 2024.

Explore our database modules

Explore now

Tags: