Auditor changes roundup: 2024 annual summary

Bush & Associates was the big winner in terms of net client gains with 30 net gains in 2024. The firm only experienced two departures while engaging 32 SEC registered companies. KPMG, the only member of the Big Four to make it into the top five firms in net client gains, had a total of 39 gains but also experienced 16 departures leaving them tied for second place with Enrome who also had net gains of 23 clients.

Global and national firms

The 10 largest audit firms experienced both highs and lows in terms of engagements and departures in 2024.

Deloitte saw the most client gains among these top firms with 42 new engagements, improving over last year’s gains of 40 new clients. Deloitte also experienced 28 departures for a net gain of 14 clients. Crowe had only five departures along with its 23 new engagements leading to net client gains of 18 and placing it second among the top ten firms in net client gains, trailing only KPMG. In addition to the previously mentioned, Forvis Mazars was the only other firm to net clients in 2024 with seven net gains.

Marcum saw the greatest net client losses among these top firms and the most departures of any firm during the year for the second year in a row. Marcum added 30 new clients in 2024 with 100 departures for a net loss of 70 clients (55 net client loss in 2023).

Marcum’s business has historically been heavily involved with the auditing of special purpose acquisition companies (SPACs). Many SPACs launched in the 2021 SPAC boom have reached the end of their lifespan of three years or have successfully merged with an operating company. There were 35 departures in 2024 for Marcum that underwent their IPO as a SPAC.

EY also experienced a high volume of departures as the firm looks to tailor its clientele. EY had 65 departures and seven engagements during the year for a net loss of 58 clients. 50 of EY’s 65 departures were dismissals from the firm.

Major mergers

Audit firm mergers are often the catalyst for significant client gains. The largest merger of the year occurred between U.S. based FORVIS and Paris based Mazars to form a global alliance under the brand FORVIS Mazars. This newly formed alliance is expected to allow for greater market access for both firms and increase global presence of the brand. Forvis Mazars experienced 12 new engagements from the merger and experienced two more engagements from a merger later in the year with MSL CPAs.

Market cap and audit fee gains

KPMG ranked highest in terms of net client market cap. Their 39 engagements and 16 departures led to a net client market cap gain of $92.6 billion. Their largest client gained during the year was Everest Group, Ltd. The Bermuda-based provider of insurance and reinsurance added around $15.7 billion to KPMGs total net market gain after they were engaged as the company’s new auditor in February 2024. Everest Group paid $5.9 million in audit fees in 2023.

Super Micro Computer, Inc., with a market capitalization of $49 billion engaged BDO after EY resigned. This new engagement was largely responsible for BDO achieving a net market cap gain of $35.8 billion and ranking third behind only KPMG and PwC in net market cap gains.

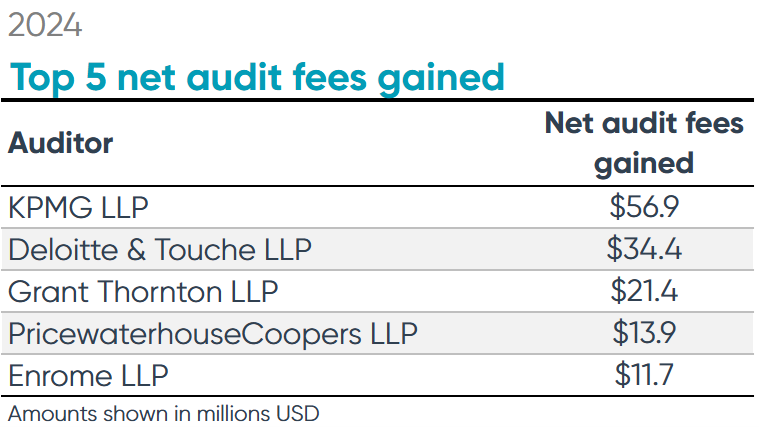

KPMG gained a net of $56.9 million in audit fees and led all auditors in this category. Both Tupperware Brands, prior to their Chapter 11 filing and subsequent sale, and UGI Corp, a distributor of liquified petroleum gas, were KPMG’s largest contributors, paying $9.4 and $9 million in audit fees for FY2023, respectively. Deloitte, who gained $49.5 million in audit fees from their new 2023 clients, ranked second with $34.4 million in net audit fees gained in 2024.

Client gains by filer status

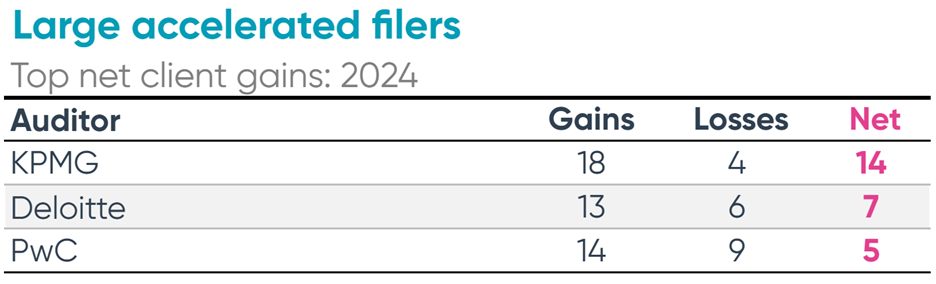

KPMG was the leader for large accelerated filer client gains in 2024 with 18 new engagements and four departures for a net gain of 14 clients. 11 of these large clients dismissed one of the other three Big Four firms in favor of Deloitte. Second-ranking Deloitte had a net gain of seven large accelerated clients during the year, while PwC gained five.

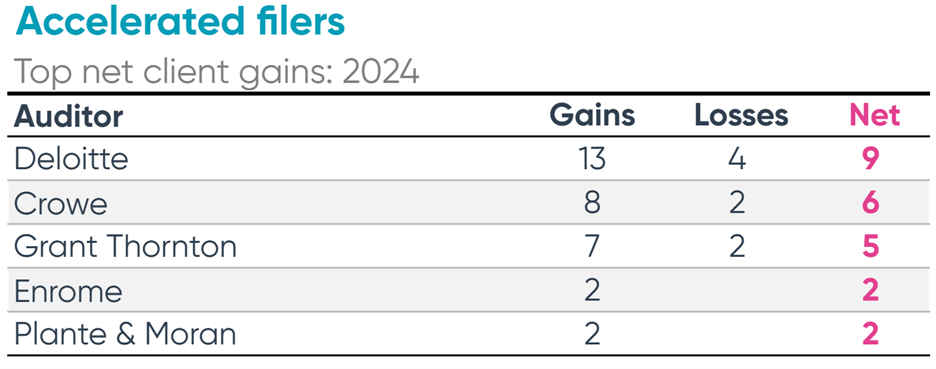

For accelerated filers, Deloitte gained the most new clients overall with 13 new engagements and four departures. Crowe followed in second with eight gains and only two departures for a net gain of six accelerated filers.

Bush & Associates led in engagements for non-accelerated filers and smaller reporting companies with 30 gains and only two losses. The next four firms in the rankings for net client gains are grouped closely at 21 and 20 gains and all experienced zero client losses of non-accelerated filers and smaller reporting companies throughout the year. Many of these firms have benefited from the collapse of BF Borgers audit practice and the subsequent exodus of clients.

Discover Ideagen audit intelligence solutions

Find out more about how Ideagen can help with your audit intelligence needs

Find out moreTags: